A UK microchip company, Arm, plans to sell its shares in the United States

Nasdaq plan to list in September, a Cambridge-based company that designs chips for smartphones, game consoles, and other devices.

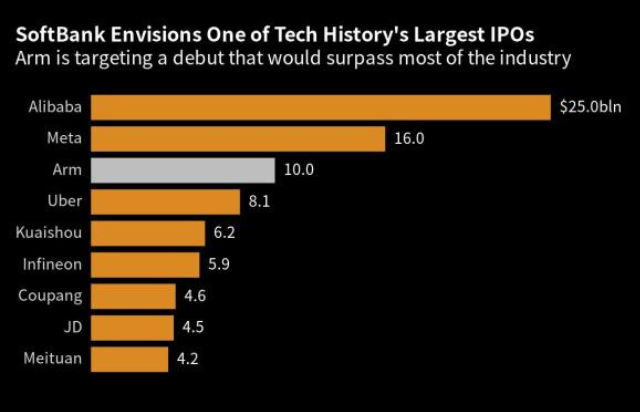

It’s proposed initial public offering (IPO) could be the biggest this year, though Arm did not reveal the number or price of shares for sale.

In March, delivering a significant blow to the UK, Arm decided against choosing London for its share listing.

Just yesterday, Arm made a noteworthy announcement, revealing that it has publicly submitted a registration statement for a potential IPO. At this point, specific details such as the number of shares to be offered and their price range remain undetermined.

You May Also Read “Amazon ‘Enhancing’ Reviews With AI“

Nonetheless, it has been widely reported that Arm is seeking a valuation ranging from $60 billion (£47 billion) to $70 billion. To provide context, Softbank, a Japanese conglomerate, acquired Arm in 2016 for a substantial £23.4 billion. Before this acquisition, Arm had maintained dual listings in London and New York for a respectable 18-year period.

Arm plays a pivotal role in the technology industry, as its chip design instructions and technologies are utilized by prominent manufacturers such as the Taiwan Semiconductor Manufacturing Company, as well as tech giants like Apple and Samsung, who rely on Arm’s innovations to produce their own cutting-edge chips.

Going public through a stock exchange fundamentally transforms a private company into a publicly-traded entity, affording investors the opportunity to buy and sell shares of the company’s stock on specific exchanges.

Previous reports had indicated that Arm was aiming to raise between $8 billion and $10 billion via its listing on the tech-focused Nasdaq platform. It’s worth noting that several major technology titans, including Google, Apple, and Facebook, are already actively traded on the Nasdaq exchange.

You May Also Read “Explore Metaverse Technologies“

What is an IPO?

An IPO, or Initial Public Offering, is a significant financial event in which a private company transitions into a publicly traded company by offering its shares to the general public for the first time. Here’s how it works:

1. Private Company to Public Company: Prior to an IPO, a company is privately held, meaning its ownership is typically limited to a small group of investors, founders, and employees. In an IPO, the company issues new shares to the public, effectively becoming a publicly traded company.

2. Issuing Shares: During an IPO, the company issues a specific number of shares to be sold to investors. These shares are offered to institutional investors, like mutual funds and pension funds, as well as individual investors, such as retail traders and the general public.

3. Stock Exchange Listing: The company’s shares are then listed on a stock exchange, such as the New York Stock Exchange (NYSE) or the Nasdaq. This provides a platform where investors can buy and sell shares in the company.

4. Capital Raising: The primary purpose of an IPO is to raise capital for the company. By selling shares to the public, the company can raise significant funds, which can be used for various purposes, including expansion, research and development, debt repayment, and other corporate initiatives.

5. Liquidity for Existing Shareholders: An IPO also allows existing shareholders, including early investors and employees with stock options, to sell their shares on the open market. This provides liquidity, allowing them to convert their ownership into cash.

6. Market Valuation: The price at which the company initially offers its shares to the public determines its market capitalization (market cap), which is the total value of all outstanding shares. This reflects the perceived value of the company in the eyes of investors.

7. Regulatory Compliance: Companies going public must adhere to stringent regulatory requirements and disclosures, as mandated by securities regulators. This includes providing financial information, risk factors, and other relevant details to potential investors.

IPOs are often seen as a way for companies to access a broader investor base and raise substantial capital to fuel growth. However, they also come with increased public scrutiny, reporting obligations, and a potential loss of control for the founders and early stakeholders. Additionally, the success of an IPO is highly dependent on market conditions and investor sentiment at the time of the offering.